-

Network with Microsoft People

Meet Microsoft Executives and Engineers

Meet Business Leaders

Meet Business Leaders and Tech Visionaries

Be where it matters

Meet the other 3,000+ great attendees

Meet New Customers

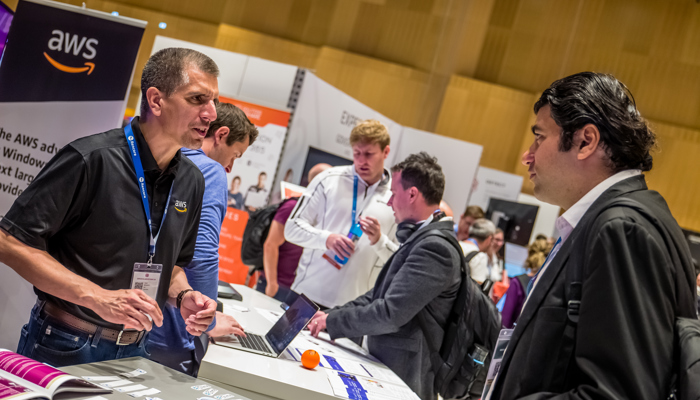

Visit Expo with 95+ Sponsors and Exhibitors

Informal business networking

Build new connections and friendships

-

Learning

Learn about the best practices and the latest capabilitie..

Sessions

Browse and search all European Collaboration Summit Sessions about M365, Copilot...

Tutorials

The pre-conference day tutorials will help you to boost your knowledge...

Agenda

Take a look at all sessions at the European Collaboration Summit

Speakers

World's best M365, Copilot, Viva, SharePoint and Teams experts and speaker....

Content Team

Professionals, worldwide acknowledged experts, world-class speakers: ...

-

The Power of Networking at CollabSummit

Learn how to benefit most from your sponsorship

Call for Sponsors

Call for Sponsors and Exhibitors

Community Support

Apply for the CollabSummit community support

Media Partners

Become a CollabSummit media partner

Sponsors 2025

CollabSummit 2025 sponsors

Sponsors 2024

CollabSummit 2024 sponsors

-

Why you should attend the European Collaboration Summit

Learn about Microsoft 365, Copilot and SharePoint directly from the Microsoft engineers who developed them.

Frequently Asked Questions

Frequently Asked Questions about the European Collaboration Summit.

The story of the European Collaboration Summit

Over the years, the European Collaboration Summit has evolved into the largest conference of its kind in the world.

Mobile App

Use our mobile app before, during and after the European Collaboration Summit.

ECS 2025 Photos and Videos

How 3000 people can feel like a family? See it for yourself: with ECS, everything is possible!

Venue

See you at the CCD Düsseldorf, Germany

- NEWS

- CONTACT

- BUY TICKETS MANAGE TICKETS